Security Center

We work hard to keep your account & information safe. Check here for important advice on how you can avoid scams and stay secure.

Report any suspicious activity directly to the Federal Trade Commission.

FILE A REPORT

MACU Fraud Monitoring

Our fraud monitoring service monitoring all MACU debit and credit card transactions for potential fraud, alerting Members to potentially suspect transactions. Members receiving alerts should respond to these alerts as soon as is convenient to avoid disruptions in service.

Alerts show up from the following numbers:

Debit cards:

Text Alerts*: 20733

Phone Alerts: (833) 735-1894

*Must be enrolled in Fraud Text Alerts. Tell a Member Experience Specialist that you'd like to enroll.

Credit Cards:

Phone Alerts: (833) 763-2013

Recent Scam Warnings

Beware of Gift Card Scams this Holiday Season

Gift cards are a common go-to gift idea for many Ohioans each year. In fact, according to a recent national survey, 44% of consumers said they expect to give a gift card as a present this holiday season.

If gift cards are on your holiday shopping list, the Division of Financial Institutions is sharing tips to help keep you safe from scams that are becoming more common.

- Only purchase gift cards from reputable sources, such as a restaurant or store itself or a larger chain that offers gift cards, such as popular grocery stores or drug stores.

- Always inspect gift cards before purchasing them to ensure the card itself nor its packaging have been bent or altered in any way.

- Avoid purchasing gift cards from third-party sources, such as online auctions, since it may be difficult to verify whether those cards still contain all or any funds.

- Maintain copies of receipts since those can be helpful in the event a scam occurs.

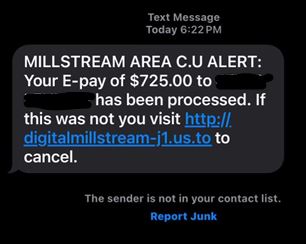

Text Phishing Scam Targeting Members & Non-Members

We’ve been made aware of a recent phishing attempt that is being sent to members and non-members through text. Our utmost concern is the safety and security of your deposits, and we're dedicated to providing you with the knowledge you need to protect yourself in these situations.

We have received reports of a scam involving a phishing attempt through texting, where fraudsters impersonate Millstream Area Credit Union. These fraudulent messages list a fake transaction and ask you to click on a link if the transaction wasn’t authorized. The link is not our website, millstreamcu.com, and you should avoid clicking on the link and providing any information.

Sample Fraud Text:

Please pay close attention to any text messages you receive claiming to be from MACU.

Be aware that Millstream Area Credit Union will never call you to ask for your full debit card number, PIN, CVV code, or 2-factor authentication codes. We will only ask you to verify your personal information when YOU initiate a call with us.

If you receive a suspicious SMS or phone call, do not provide any personal information. Instead, ask for the caller's name, hang up, and immediately contact our member experience specialists at (419) 422-5626. Our team will verify the information and provide necessary guidance.

Your security is our top priority, and we're here to assist you every step of the way.

Thank you for helping us keep your accounts safe!

Keeping Your Account Safe This Holiday Season

Holiday Spending is certainly something that is on everyone's mind right now. What you may not be thinking about are all of potential security risks involved with Holiday shopping.

Here are some common holiday-themed scams, and tips to avoid them, that Betty Lin-Fisher at USA Today put together. These come from a variety of sources, including Wells Fargo, Chase Bank, BMO, Feedzai, a company that helps financial institutions manage their fraud and BioCatch, a company that works with banks to protect their customers from fraud and scams:

◾ The “it” toy scam: Scammers target emotions and frazzled parents trying to get the hottest toy with fake links. Make sure you are interacting with a reputable retailer and not clicking on unsolicited emails, said Alvarez with Wells Fargo.

◾ Fake package notifications: Be careful of clicking on an unsolicited text or email pretending to be from a legitimate company to "track" your package or help with a "lost" package.

◾ Fake charities: Scammers know people are generous at the end of the year with charitable giving. Research the charity to ensure you are donating to a legitimate cause, according to Wells Fargo.

◾ Holiday/seasonal job scams: There's a rise in part-time work during the holidays to make some extra cash. But scammers also make up fake jobs to get your money and personal information, according to Wells Fargo.

◾ Beware of gift card scams: Be careful of buying gift cards from third-party sites, said Chase Bank. Scammers will pre-save card details or sell expired cards. Don't answer unsolicited emails or text messages offering you a gift card; it could be a way to track your online activity.

◾ Watch for unsolicited “friendly” messages on social apps: Scammers first try to hook you by starting a friendly conversation and then asking for money once they earn your trust, said Chase Bank. Be careful of accepting requests from contacts you don't know and never send money.

◾ Deals that are too good to be true: Scammers will lure shoppers with deeply discounted prices or offers that are simply unbelievable, according to Feedzai. If a deal seems too good to be true, it probably is. Do your research and compare prices from different retailers before making a purchase.

◾ Double-check the website: Scammers often create fake websites that look just like legitimate online stores, according to Feedzai. Triple-check the URL web address for a slight variation in the spelling of a popular website. Look for a padlock icon on the address bar and check for "https" to indicate a secure connection.

◾ Use a secure payment method: Whenever possible, use a credit card for online purchases, said Feedzai. Credit cards offer more protection against fraud than debit cards or peer-to-peer payment apps.

◾ Be skeptical of product reviews and testimonials: Artificial intelligence can be used to create fake reviews and testimonials. Do your own research and look for reviews from trusted sources, said Feedzai.

◾ Payment app scams: Scams involving payment apps run all year long, according to BioCatch, but the volume is expected to increase during the holiday season. Most of these scams start with a call from someone pretending to be your bank or credit card company, saying there has been fraud detected on your account. They'll try to get you to transfer the money to an account to "protect" it, but it's actually an account for the scammer.

Scammers Exploit 2024 US General Election to Perpetrate Multiple Fraud Schemes

The FBI is warning the public about scammers exploiting the 2024 US General election to perpetrate multiple types of financial fraud schemes. These scams target victims across the United States and have previously exploited state and local elections for similar scams.

Scammers use the names, images, logos, and slogans of candidates to fraudulently solicit campaign contributions, sell merchandise (which is never sent to the purchaser), or steal victim personally identifiable information (PII) that can be used for other fraud.

- Campaign Investment Pool Scheme

- Victims are promised a return on their campaign contribution dollars if they invest in a pool to fund the candidate's campaign. The pool is guaranteed to grow and be returned to the victims after the candidate wins. Victims are also encouraged to recruit others to invest in the pool to increase their share of the payout.

- Scam Political Action Committees

- Victims are contacted by a scammer who misleads the victim to believe the scammer is affiliated with a legitimate Political Action Committee (PAC), such as a Super PAC or candidate’s campaign committee. The victim is duped into believing they are making a legal campaign contribution to a legitimate PAC but instead the scammers keep the funds for themselves and have no affiliation with the specified PAC.

- Merchandise Online Purchase Scam

- Victims are enticed to purchase merchandise with the logo of a political candidate though the company is not associated with the political campaign and does not ship the purchased product. This is a classic "non-shipment scam" or "non-delivery fraud" scheme taking advantage of victim's interest in the 2024 election.

- Scam Voter Registration

- Victims receive a text message or email stating they are not registered to vote in their state and encouraging them to click a link that takes the victim to a fraudulent state voter registration page. The victim may or may not already be registered to vote with their state. This scheme is a means to steal PII for identity theft and potentially to further target victims for additional scams.

Tips to Protect Yourself

- Be cautious when receiving any unsolicited calls, texts, emails, or surveys. Do not provide your personal information to persons you do not know. Do not click on unknown links.

- Donations to a political campaign will not act as an investment; they will not increase in value then be returned to you.

- Check the registration status of a Political Action or Party Committee on the Federal Election Commission (FEC) website. Additional due diligence may be necessary because some scam PACs are known to be registered with the FEC.

- Research a company online before making any purchase by looking up customer reviews and BBB.org complaints.

- Check your voter registration status at www.vote.gov.

Report It

The FBI requests victims report these fraudulent or suspicious activities to the FBI Internet Crime Complaint Center (IC3) at www.ic3.gov as quickly as possible. Be sure to include as much information as possible:

- The name of the person or company that contacted you.

- Identifying information about the company and/or individuals who contacted you, including phone number, address, email address, and websites.

- Financial transaction information including method of payment.

- Describe your interaction with the individual, including how contact was initiated, the type of communication, what you were told or instructed, what you provided, and any other details pertinent to your complaint.

Victims aged 60 or over who need assistance with filing an IC3 complaint, can contact the DOJ Elder Justice Hotline, 1-833-FRAUD-11 (or 833-372-8311).

Counterfeit Check Scam Targets Law Firms Via Debt Collection Scheme

The FBI warns of a counterfeit check scheme in which fraudsters target law firms engaged in collections work by deceptively contracting their services to ultimately defraud them. It may focus on any type of representation where a lawyer is hired to assist in the transfer or collection of money, e.g. real estate, collection matters, collaborative law agreements in family matters, etc. This scenario continues to be replayed as part of a sophisticated scam that targets collections lawyers and the scope is constantly evolving.

How the Scheme Works:

- A law firm is contacted regarding representation in an alleged debt collection matter by what appears to be a legitimate prospective client ("the Creditor").

- The law firm agrees to help and sends a demand letter to the alleged debtor ("Debtor").

- The Debtor immediately agrees to pay the debt and sends what appears to be a valid cashier's check to the law firm.

- The law firm deposits the check into their client trust account and transfers the value to the Creditor via wire, less any legal fees agreed upon.

- The law firm's bank then discovers that the check is actually fraudulent and the trust account is charged back the value of the check.

- Because the wire has already been sent to the Creditor, the law firm is left to suffer the financial loss.

Variations of the Scheme

Though the structure of the scheme is primarily the same, there can be some variation regarding the reasoning for the debt and engagement of services as well as the types of fraudulent checks.

- In one common scenario, the subject alleges to be collecting a debt from a family member through marriage. The debtor's name is usually something innocuous and common, likely to increase the chances of someone by that name residing in the victim’s area.

- In another variation, the alleged debtor is a business and the purported dispute is over a workplace injury complaint. The name of a legitimate global technology company is currently being used in this type of scheme. However, in these scenarios, the victim may be a genuine business who is themselves a victim, or a fraudulent business designed by the subject to facilitate the scheme.

- Many of the cashier's checks involved in this counterfeit check scam are seemingly drawn from a genuine Canadian bank, likely increasing the time it takes to verify the validity of the check and available funds.

- The creditor is also often located internationally, which is used to assist the scheme by offering justification for delayed communication and/or other excuses the subject employs throughout the scheme.

Tips to Protect Yourself

- Be suspicious of requests or pressure to take action quickly. A number of potential victims were able to successfully identify the fraudulent check by adhering to policies which required a delay or hold on the funds until confirmation that the debtor’s check had indeed cleared into their client trust accounts.

- Consider additional financial security procedures, such as two-step verification or telephone calls (subjects tend to prefer written correspondence), to verify transaction details and identity information, prior to wiring funds.

- Contact your financial institution immediately and request that they contact the financial institution where any wire transfer was sent to determine if it is able to be recalled or the funds frozen in the deposit account.

The FBI requests victims of an internet crime file a complaint with the Internet Crime Complaint Center (IC3) at www.ic3.gov.

Always remember

Unless you are working with a Member Experience Specialist on a loan or account-related issue, MACU will never solicit personal information (including Social Security numbers, online banking passwords/usernames, personal identification numbers, or account numbers) over the phone, by email, or through text messaging. We ask you to please be aware of all types of solicitation inquiring about sensitive information. If you receive a phone call, email, text message, or any other form of solicitation requesting your personal information, please contact us immediately.

Important Resources

Cybersecurity Resources for Older Adults

National Council on Aging (NCOA)

Senior Fraud Prevention Toolkit

Cybersecurity Resources for Youth

National Cyber Security Alliance (NCSA)

StaySafeOnline

Federal Communications Commission

1-888-225-5322 | 1-888-835-5322 (TTY)

Consumer & Gov’t Affairs

Federal Trade Commission

1-877-438-4338

1-866-653-4261 (TTY)

IRS

1-800-908-4490

Taxpayer Guide to Identity Theft

Consumer Financial Protection Bureau

The latest federal information on consumer protection

Consumer Financial Protection Bureau (consumerfinance.gov)

FTC Consumer Protection Notices

- FTC and Justice Department to Host First Public Strike Force on Unfair and Illegal Pricing Meeting

- FTC Announces Tentative Agenda for August 1 Open Commission Meeting

- FTC Issues Orders to Eight Companies Seeking Information on Surveillance Pricing

- FTC Acts to Stop Debt Relief Scheme Targeting Spanish-Speaking Student Loan Borrowers

- FTC and FDA Send Second Set of Cease-and-Desist Letters to Companies Selling Products Containing Delta-8 THC in Packaging Designed to Look Like Children’s Snacks

- FTC Takes Action to Ensure Franchisees’ Complaints are Heard and to Protect Against Illegal Fees

- FTC Publishes Inflation-Adjusted Monetary Thresholds for Three Exemptions in Franchise Rule

- FTC, ICPEN, GPEN Announce Results of Review of Use of Dark Patterns Affecting Subscription Services, Privacy

- Commission Testifies before House Energy and Commerce Subcommittee on Innovation, Data and Commerce

- FTC Order Will Ban NGL Labs and its Founders from Offering Anonymous Messaging Apps to Kids Under 18 and Halt Deceptive Claims Around AI Content Moderation